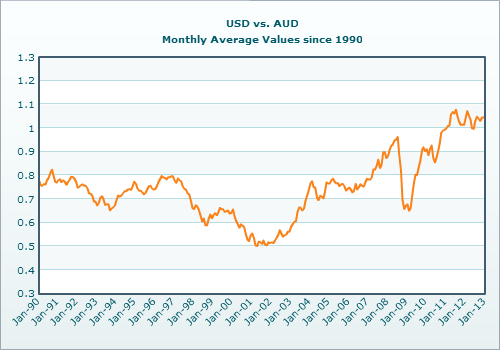

Is the Australian Dollar Really Overvalued?

No, the Australian dollar is definitely not overvalued – it only looks that way to some people because it has hovered around US$0.75 for 30 years, but as the world economy has changed over the last few years, so have the values of world currencies relative to each other. This has resulted in the Australian dollar being where it is currently at. In this article, we will explain why.

Read more

Four Ways You Can Save Money On Books

Not many people would dispute that Australian consumers get ripped off when buying books.

I first noticed this in the year 2000, when the GST was introduced by the Howard government. I was a university student, and the cost of a single textbook had broken the $100 barrier. It seemed that book prices had virtually doubled overnight. When I asked the manager, I was told that the introduction of the 10% GST and the new accounting procedures added a lot of overhead.

I think that’s only a small part of the explanation:

In Australia, four chain bookstores dominate retail book sales: Dymocks, Angus & Robertson, Borders & the Co-op Bookshop. They are traditional walk-in bookshops with large displays, elaborate decorations and many staff. Online book retailing in Australia has not yet reached the mainstream as it is in the USA and Europe.

Also, Australia has controversial laws preventing parallel importation – stores are not allowed to legally sell a cheaply imported book published overseas if the same book has also been published locally. There have been calls to change these laws to allow parallel importation, but I doubt it will reduce prices significantly.

Despite this, there are still many things you can do to avoid overspending on books. Here is a list:

ASIC To Replace ASX As Supervisor of Australian Financial Markets

Filed under: Australian News, Business, Finance and Investment

Someone asked me what I thought about the government’s decision to give our official corporate regulator, the Australian Securities and Investments Commission (ASIC), responsibility for supervising real-time trading on Australian markets, as announced by Treasurer Wayne Swan.

That means that ASIC would be responsible for investigating and uncovering insider trading, market manipulation and other fraudulent practices that occur on financial markets.

This responsibility was previously assigned to the market operator, the Australian Securities Exchange (ASX). Since the ASX demutualised and became a publicly listed company in 1998, it has been argued that there is now a conflict of interest between its duty to supervise the markets and its duty to maximise profits for its shareholders. That was the government’s reasoning for ordering the transfer of powers.

My answer is that I agree that there is a conflict of interest, but I do not believe ASIC is competent enough to carry out its new duty. ASIC is under resourced, inefficient and has a culture of apathy and incompetence. In addition, they lack the ASX’s technological know-how. The government did not mention how much extra funding they were going to allocate, if any.

I want to hear more about plans for extra funding and a cultural purge before I would have any degree of confidence in the new arrangements.

The Teenager Who Almost Became an Airline Tycoon

Filed under: Business, Finance and Investment, International News

I am always inspired by creative young people who start with with no money, connections and end up doing really clever things to hit the big time.

In the media, it has been reported that a 17-year old British ‘autistic’ teenager from Yorkshire was attempting to set up a new Channel Islands-based airline that would service most of Europe.

He pulled this off by creating a number of bogus websites, and using virtual office services in a number of countries and writing convincing letters and emails to air industry bosses, which led to telephone conversations and face-to-face meetings.

His mistake came undone after an aviation magazine, who ran an article on his business, got suspicious and started snooping – his biggest mistake was using his own voice to impersonate several different people. In my opinion, he should have invested in one of those voice changing gadgets and learnt to speak and switch between several British regional accents.

His real name has not been published, but he is referred to one of the pseudonyms he used – Adam Tait.

The reports said that he was autistic, but I find this very hard to believe considering the number of social interactions he had. At worst, he would probably have suffering from some form of Aspergers syndrome, in which individuals are high-functioning.

Here are a few articles that tell the story in details:

http://business.timesonline.co.uk/tol/business/industry_sectors/transport/article6719191.ece

http://www.airliners.net/aviation-forums/general_aviation/read.main/4487857/

http://www.muscletalk.co.uk/17yearold-with-autism-pulls-off-identity-stunt-of-the-decade-m3504726.aspx

Still, I am not convinced that he would have failed. I wish they had let this go on a bit more and see where he would have gotten up to. I do believe that creative young people have to struggle to get a fair go and face many forms of discrimination in society.

Take Advantage of the Small Business Investment Allowance

Filed under: Australian News, Business, Finance and Investment

The current Financial Year 2008-2009 ends at midnight next Tuesday 30th June, so now is a good time to take advantage of any tax benefits that you are entitled to.

As part of the Australian Labor Government’s measures to try and stimulate the economy, the Small Business and General Business tax break legislation went into effect on the 22nd of May 2009.

The allowance in a nutshell is this:

if you run a small business with a turnover of less than $2 million and buy an eligibile depreciating asset costing over $1000, you can make an additional one-off 50% tax deduction. This is in addition to the all the normal tax deductions on assets used to earn an income.

If your business is bigger, you still get an additional deduction, but it’s only 30%.

Full details can be found here on the Australian Taxation Office’s website:

The website smartcompany.com.au has a well-written explanation in their article “New details on the 50% small business tax deduction“.

Some examples of tangible depreciating assets include new computers, peripherals, furniture, vehicles and tools. Computer Software does not count as it is not considered tangible and does not depreciate.

How To Find Your Unclaimed Money

In the aftermath of a global financial crisis, people are having to make greater efforts to make ends meet and support their families. People are working extra hours, reducing their household spending to improve their cashflow and selling things to reduce debt.

But I am sure that many people would be struggling a whole lot less if they found and retrieved their unclaimed money! In Australia alone, over $500 million dollars in unclaimed money is being held in trust by ASIC and other government bodies.

This article explains where unclaimed money comes from and tips of searching and retrieving money that you may own.

Read more

Investing in Gold Made Easy

WARNING: This article is old. The information is mostly out of date.

Many people like to own some gold. It’s a shiny yellow metal and brings up romantic images of Pirates, Spaniards, the Wild West, James Bond Movies, Fort Knox, Bullion, Nuggets and Jewellery.

It also has a reputation for being stable and immune to the inflation and devaluation that affect fiat (paper) currencies. Wars and economic uncertainty almost always spark interest in the metal.

I personally don’t care much for gold as an investment because it generates no income, but a reader asked for my opinion on what are the most convenient and cost-effective ways to invest in gold.

I consider the following methods to be the most convenient due to their accessibility, ease of use and relatively low fees. I must note that I have never personally used them.

Exchange-Traded Gold Bullion Securities

These are listed stocks that allow investors to buy a share in an allocation of gold that is held by a trustee in a vault. Each share represents a beneficial interest in a unit quantity.

For example, each share in the ASX-traded stock ‘GOLD’ entitles the shareholder to a beneficial interest in approximately 1/10th of a troy ounce of gold, and the share price trades at the current Australian dollar value of that amount (AUD$115.70 at the time of writing).

For an investor, the only immediate expenses are brokerage and the buy-sell spread. There are internal administration expenses such as gold storage fees and these are reflected in the share price.

More information can be found here:

http://www.goldbullion.com.au/

http://www.exchangetradedgold.com/

Online Digital Gold Certificates

These are a form of electronic money that is based on unit amounts of gold. These are issued by private companies that operate websites, the most famous being E-Gold. Think of it like Paypal, except your account balance is measured in ounces or grams of gold.

You can top-up your account by purchasing gold at the current market price in a supported currency, and you can redeem gold at the current market price. You can send and receive any gold, to and from other parties. Each time you carry out a transaction, you are typically charged a commission, based on a fixed quantity or a sliding percentage scale.

Online digital gold currencies have generated controversy due to their abuse by fraudsters and money-launderers. Questions have also been raised about the proportion of clients’ funds that are actually held in gold bullion, but I am not aware of any cases in which the digital gold providers did not meet their financial obligations to clients.

More information can be found here:

http://en.wikipedia.org/wiki/Digital_gold_currency

Stock Valuations and Kevin Rudd’s $1M Bank Deposit Guarantee

Filed under: Australian News, Business, Finance and Investment, Uncategorized

Hello Everyone,

Pardon the sparseness of my posts in the last fortnight. I have been reading and thinking very hard. For me, it is important to try and say something meaningful rather than contribute to the endless media waffle concerning the current financial crisis that does nothing more than waste time and confuse people further.

As first glance, many ASX stocks look incredibly cheap based on historic valuations. There are now heaps of shares that have P/E ratios less than 10, and offer fully-franked dividend yields greater than 10%. These are not just the battered property trusts who have high debt – many of these companies are in other sectors and are still reporting record earnings growth. So why aren’t these companies’ share prices going up?

The reason is that sentiment is very very poor. The market is anticipating future drops in earnings over the next few years as the financial crisis runs its course. People lack accurate, trustworthy information, so they are expecting the worst.

I personally see reasons to be positive. Emerging markets like Brazil, China and India are still growing strongly, and many Australian companies have exposure to these economies. There will still be demand for cheap consumer goods. Plenty of money will still be made in biotechnology and agriculture.

My share portfolio has been battered heavily – I have many small cap stocks which naturally are more volatile and lack liquidity, but they’ve all been paying their dividends like clockwork and most of these dividends are higher than last year. I do not buy shares that do not pay a good dividend – I see the dividend as a mark of business stability and compensation for periods of stagnation.

Right now, I expect the market to see-saw up and down for a prolonged period. I am looking at ways to take advantage of this. One area I am reading up on is the investment technique known as Value Averaging. Most people are familiar with Dollar Cost Averaging, in which one regularly invests a fixed amount of money into a share or managed fund, regardless of the price.

With Value Averaging you vary the contributed amount depending on the value of your portfolio at the end of each time period, in order to reach a pre-defined target. The end effect is to buy more shares when prices are lower and buy fewer shares when prices are higher. Research has shown Value Averaging to outperform Dollat Cost Averaging about 95% of the time. I plan to write a post on this in the near future. If you can’t wait, click on the above link.

In other news, on the 12th of October, Prime Minister Kevin Rudd surprised everyone by announcing a package to provide an unlimited guarantee on bank deposits. The financial markets reacted like an agitated grizzly bear hit with a tranquiliser dart – there was a day of temporary euphoria, followed by a swift return to instinctive behaviour.

A week later, Kevin realised that the package may have been overly generous and he announced that the bank deposit guarantee would be limited to $1 million. Beyond this amount, bank account holders would have to pay for insurance.

I question the wisdom of this scheme. Although this may have allayed consumer fears about the solvency of banks, it may have had the unintended side effect of further fuelling an exodus from shares and other asset classes into this newly created ‘perfect safe haven’.

Furthermore, in the event that the financial crisis worsens and a bank does become insolvent, where is the Government going to get the money to meet their guarantee obligations? Probably by printing more money! This will cause increased inflation and devalue everyones’ wealth. Nonetheless, this is probably far more emotionally palatable than going to your bank and being told that your money is gone.

Speaking of inflation, the Australian Bureau of Statistics stated that the Consumer Price Index (CPI) will reach a 13-year high of 5% this year. The current interest rate on Australian bank deposits is around 6%-6.5% per annum, so people who have their money in cash will be treading water.

In contrast, corporate earnings are more resistant to inflation. Assuming that demand remains constant, corporate revenue rises with inflation. For this reason, I see better value in making defensive investments in defensive low-debt stocks than blindly putting money in the bank, unless you need to access your money in the short-term.

The Great Short-Selling Swindle Explained

Filed under: Business, Finance and Investment, International News

The recent decisions by major market regulators to reduce market volatility by restricting short-selling have generated much controversy.

Most media coverage has sought to educate the public as to what short-selling is and debate whether the growth of the practice is a cause or merely a symptom of the financial crisis gripping the world. Questions have also been raised as to whether it should be permitted or not.

Despite this, I have not seen anybody attempt to explain how short-selling has been abused in the last year to lead us to the situation we have today.

This article aims to uncover how short-selling has been abused as a tool of market manipulation and deception on the Australian Markets (the ASX). Before continuing, it is essential that you understand the following terms: short-selling, hedge fund, short-position, long-position, margin calls and stop-loss order.

How to Take Advantage of the First Home Saver Scheme

Filed under: Australian News, Business, Finance and Investment, Reviews, Uncategorized

The Australian Government does not concern itself much with the affairs of young people these days – we have an aging population and the young person’s vote is not considered important, but every now and again, it throws a token gesture their way.

By this, I am talking about the First Home Saver Scheme, which commenced last Wednesday, the 1st October.

Read more